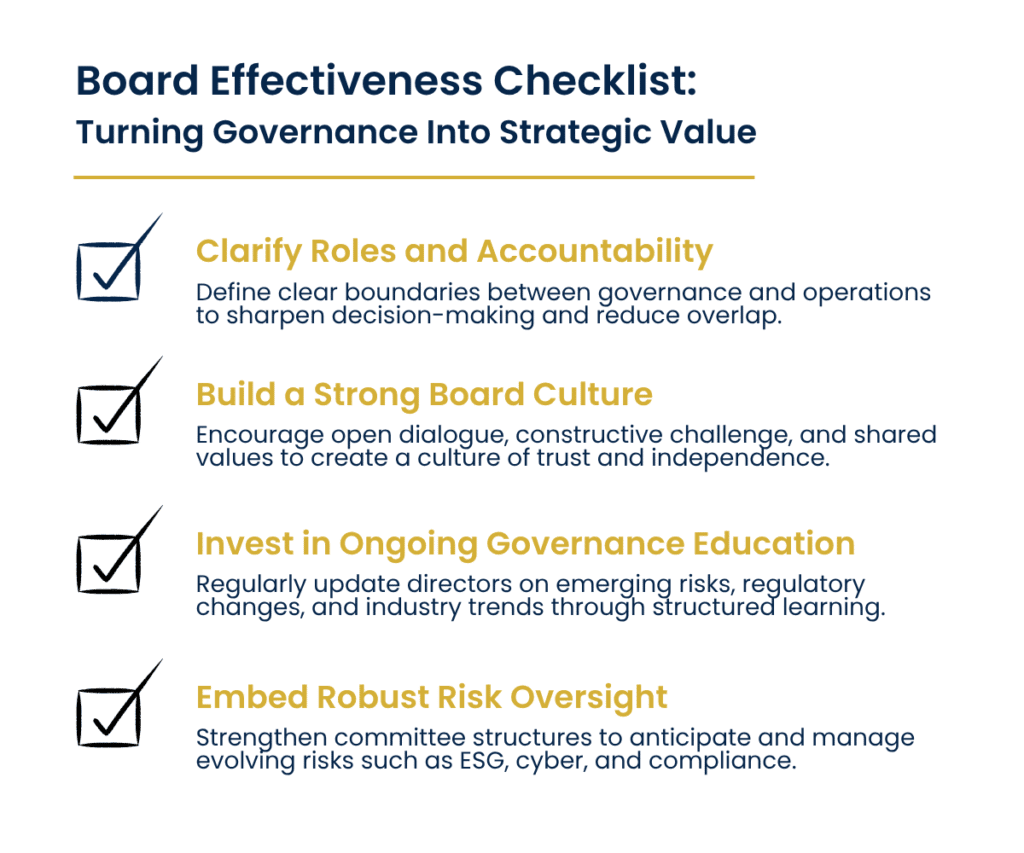

At EC1 Executive, we specialise in connecting senior leaders across FinTech, Venture Capital, and Private Equity. While our core focus is executive and C-suite appointments, we know that board experience – whether joining one or engaging closely with it – is increasingly critical to driving strategic impact. Through our searches, we support organisations in identifying leaders who not only deliver results but also understand board expectations and navigate governance dynamics from day one.

With a global presence across four offices and 36 dedicated consultants, EC1 Executive has delivered over 3,500 successful executive assignments worldwide. Our mission is to help organisations identify, attract, and retain exceptional leadership talent while guiding newly appointed executives to build productive relationships with their boards. By providing insight into board expectations and facilitating early engagement, we help leaders align with board priorities and drive impact from the outset.

This combination of sector expertise and board-aware leadership gives us a unique perspective on a recurring challenge: boards that are not functioning as effectively as they could. Board benchmarking surveys indicate that up to 25% of boards are considered dysfunctional, reflecting structural weaknesses and misaligned culture. In fast-moving, heavily regulated sectors like FinTech and financial services, these issues can directly affect strategy, risk oversight, and organisational performance

To explore this further, we spoke with Lucy Nottingham, Senior Director, Governance Content at the NACD (National Association of Corporate Directors), whose perspective blends US-based NACD

governance insights with a global view on board excellence and governance best practices.

We discuss:

- The Rising Issue of Board Dysfunction

- Why Effective Boards Matter in Fintech and Financial Services

- Culture and Structure: Two Sides of the Same Coin

- Leadership Decisions and Board-CEO Dynamics

- The Role of the Board Chair

- Practical Steps to Enhance Board Effectiveness

The Rising Issue of Board Dysfunction

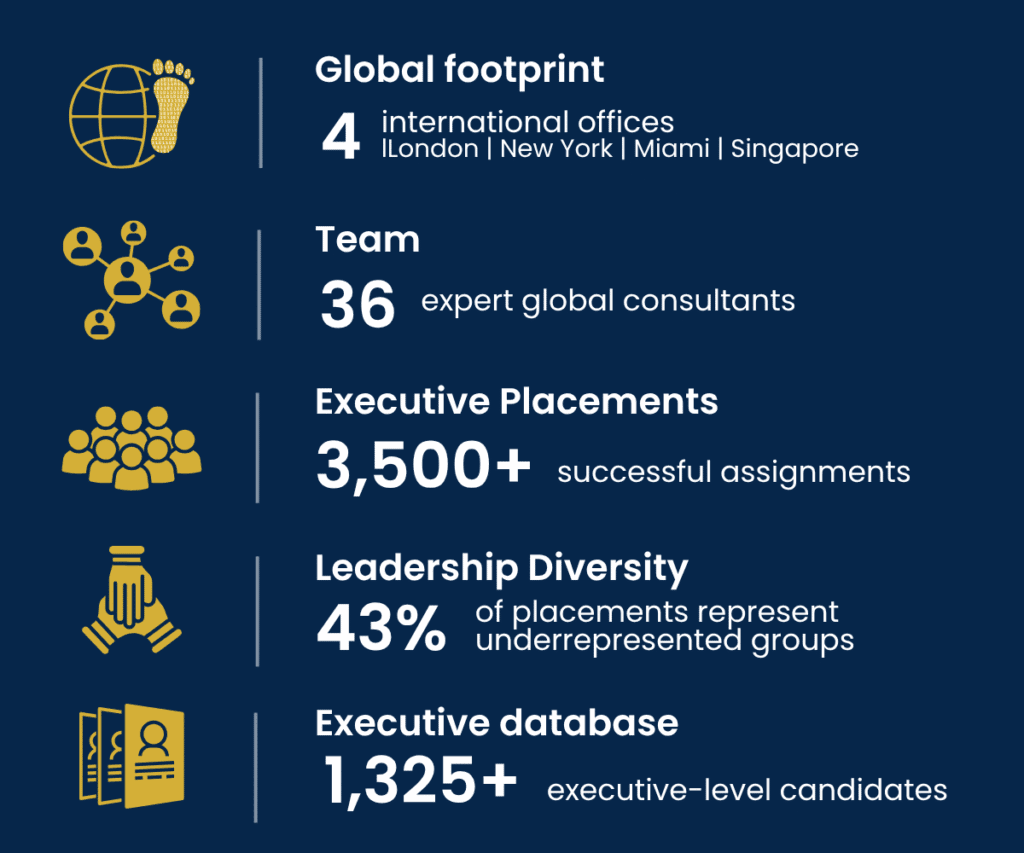

Figure 1: How Board Dysfunction Develops: A Flow of Misalignment

Board dysfunction is rarely the result of a single failure or individual. Often, it stems from subtle misalignments – subgroups dominating discussions, unclear responsibilities, or poor board processes. These dynamics slow decision-making and hinder strategic agility.

Lucy Nottingham explains:

“Dysfunction often stems from poor relationships and ineffective engagement but can also be the result of ineffective board processes.”

For executives and leadership teams, recognising these early warning signs is critical. Dysfunction is often less about visible mistakes and more about the underlying tension that erodes dialogue. Leadership teams can help by fostering transparency, establishing clear communication channels, and reinforcing a culture where the board is engaged and informed.

Why Effective Boards Matter in Fintech and Financial Services

In fintech, boards must balance regulatory oversight, innovation, and strategic foresight. Weak governance risks missed growth opportunities, compliance gaps, and diminished investor confidence.

Lucy Nottingham emphasises the strategic impact of culture:

“Failing to establish an effective boardroom culture – is akin to opening Pandora’s box. Tone at the top is critical.”

Effective boards act as strategic partners providing value extending beyond the oversight role. Leadership teams can support this by sharing timely insights, clarifying priorities, and inviting directors to contribute proactively without micromanaging operations. A collaborative executive-board relationship strengthens decision-making and ensures that directors guide strategy with context, not conjecture.

Culture and Structure: Two Sides of the Same Coin

Many boards focus on structure – charters, committees, protocols – but overlook the underlying culture. Even well-designed processes fail if directors avoid challenging assumptions, communicate poorly, or allow conflict to fester. Culture and structure must reinforce one another.

Lucy Nottingham notes:

“Early warning signs include reluctance to challenge ideas, lack of engagement, poor preparation, or friction during discussions. Boards need culture and structure to reinforce each other, rather than operate in isolation.”

Executives can contribute by modelling constructive debate, preparing thoroughly for board interactions, and helping clarify where decisions require board input versus operational execution. Structural clarity gives directors confidence, while a strong executive partnership ensures the board uses that clarity to add strategic value.

Leadership Decisions and Board-CEO Dynamics

CEO succession planning is a core board responsibility, but many boards treat it as a discrete event. Routine, candid dialogue strengthens trust, aligns expectations, and reframes leadership succession for the organization as a shared responsibility rather than a judgment event.

Lucy Nottingham advises:

“Embedding CEO succession planning conversations from day one is key. Make it a routine, candid dialogue rather than a judgment event. This reframes leadership planning as a shared focus on the organization’ success thereby improving trust and openness between the CEO and the board.”

Leadership teams can strengthen succession planning by proactively sharing transparent performance data, highlighting strategic challenges, and openly addressing capability gaps. When executives create a culture of openness around leadership readiness and development, boards are better positioned to provide forward-looking guidance rather than reactive oversight. This shifts the focus from short-term evaluation to long-term leadership continuity—ensuring that CEO succession becomes an ongoing process that builds organisational resilience, not just a moment of transition.

The Role of the Board Chair

The board chair is central to boardroom culture, discussion quality, and decision-making. Effective chairs guide new directors, manage unproductive behaviours, and ensure committee structures reinforce strategic priorities.

Lucy Nottingham observes:

“The chair sets the tone, shapes dialogue quality, and manages unproductive behaviours. Leadership style matters less than the ability to foster respect and keep discussions on track.”

Chairs and executive teams can work together to ensure that agendas are clear, discussions are focused, and emerging risks like technology, ESG, and regulatory change are addressed proactively. By recognizing the chair’s leadership, executives contribute to high-functioning board environment.

Practical Steps to Enhance Board Effectiveness

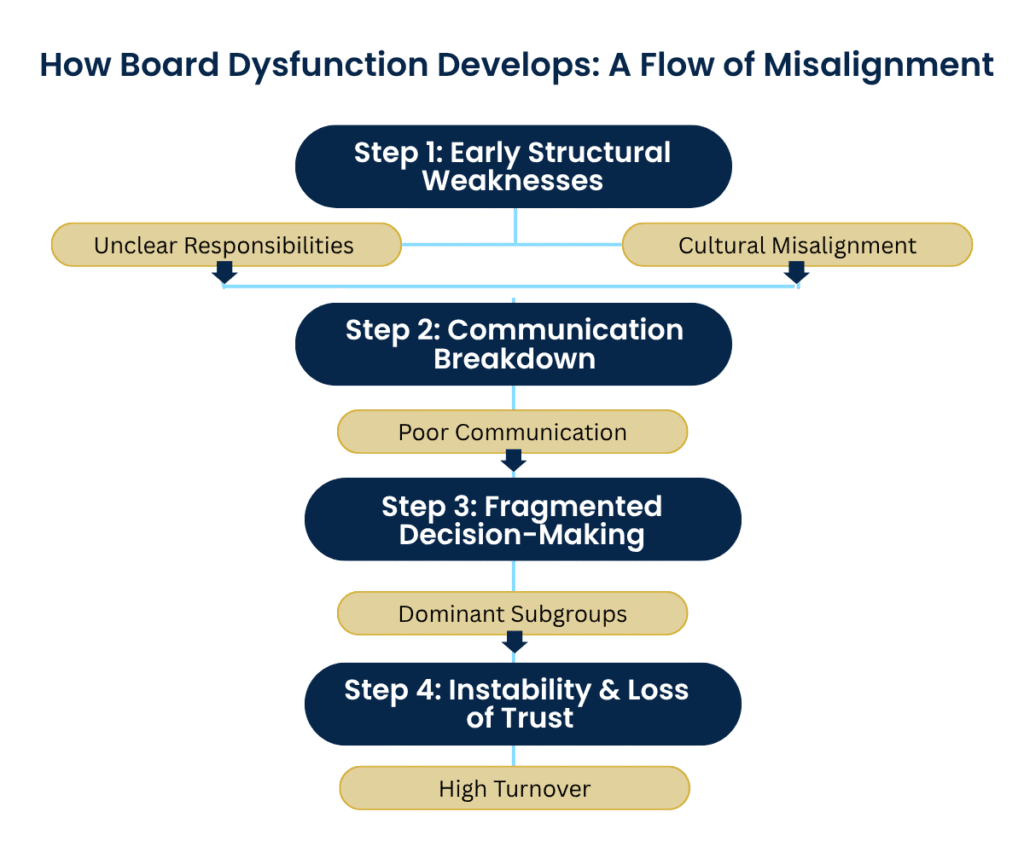

Figure 2: Board Effectiveness Checklist: Turning Governance Into Strategic Value

Boards can take deliberate steps to address dysfunction:

- Clarify roles and accountability: Set the foundational understanding for new CEOs with clear delegations of authority to the CEO and respect for operational boundaries.

- Building a strong board culture: Encouraging debate, shared values, and independence will only support more productive working relationships.

- Consistently investing in governance education: Utilising frameworks from NACD, IoD, and WEF.

- Embed risk oversight: Ensure committee charters evolve to address emerging risks like cybersecurity, ESG, and regulatory changes.

Lucy Nottingham highlights the demands on directors:

“Board members typically spend around 300 hours per year per board, including prep and meetings. Prospective directors must understand the real time and effort involved before joining.”

“Sustaining governance excellence depends on matching the right people to the right roles and ensuring ongoing support through education, process clarity, and culture alignment.”

Leadership teams can reinforce these efforts by providing timely insights, preparing thoroughly for discussions, and helping directors focus on strategic priorities rather than operational minutiae. When executives actively partner with their boards, culture, clarity, and risk oversight are strengthened, creating a foundation for sustainable growth.

Conclusion

Dysfunctional boards create tangible risks for strategy, culture, and risk management. But with deliberate attention to culture, structure, and role clarity, boards can be effective partners for management. Strong chairs, committed directors, and proactive governance elevate boards from oversight bodies to strategic enablers.

For executives and leadership teams, contributing to a functional board relationship – through transparency, preparation, and active collaboration – ensures that governance becomes a driver of growth and resilience, not just a compliance exercise. In financial services and fintech, this combination of agility, foresight, and cultural intelligence is essential for long-term success.

Why Our Clients Choose Us

Figure 3: EC1 Executive “By the Numbers”

If you’re an executive navigating board dynamics or seeking to strengthen your organisation’s governance, EC1 Executive can provide insight, guidance, and access to exceptional leadership talent. Get in touch and connect with our team to explore how we partner with boards and executives to drive strategic impact and sustainable growth.

Executive Search Team

Figures:

Figure 1: How Board Dysfunction Develops: A Flow of Misalignment

Figure 2: Board Effectiveness Checklist: Turning Governance Into Strategic Value

Figure 3: EC1 Executive “By the Numbers”